Tax Optimisation Belgium

Tax Optimisation

The tax cost of your vehicle can be optimised on the basis of the proven percentage of private use:

- no Benefit in Kind (BIK) for purely professional use

- BIK of a light commercial vehicle always depends on the proven percentage of private use

- the amount of VAT for private use can be adjusted downwards

Mandatory trip registration

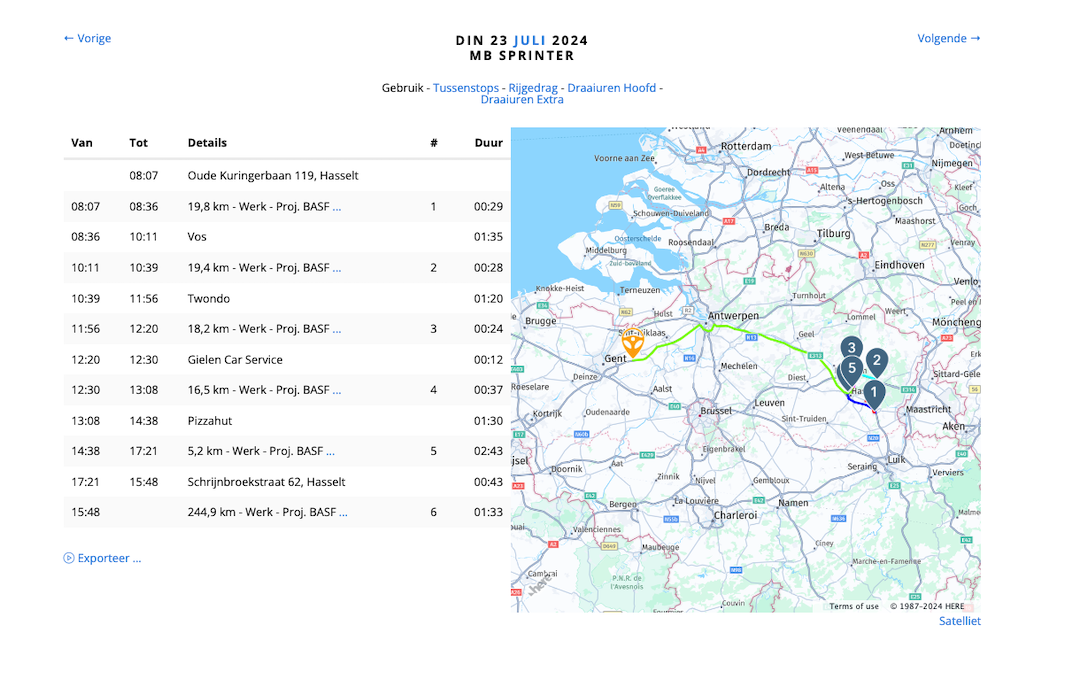

In all cases, the tax authorities require a trip record. The following data must be kept:

- date of trip

- the departure and arrival addresses of the trip

- the distance of the trip

- the total number of kilometres driven per day

- the odometer reading at the beginning and end of the year

The way in which these records are kept can be manual (on paper) or electronic, for example via the ProDongle Trip Registration. It is obvious that the more information is available, the less discussion is possible.

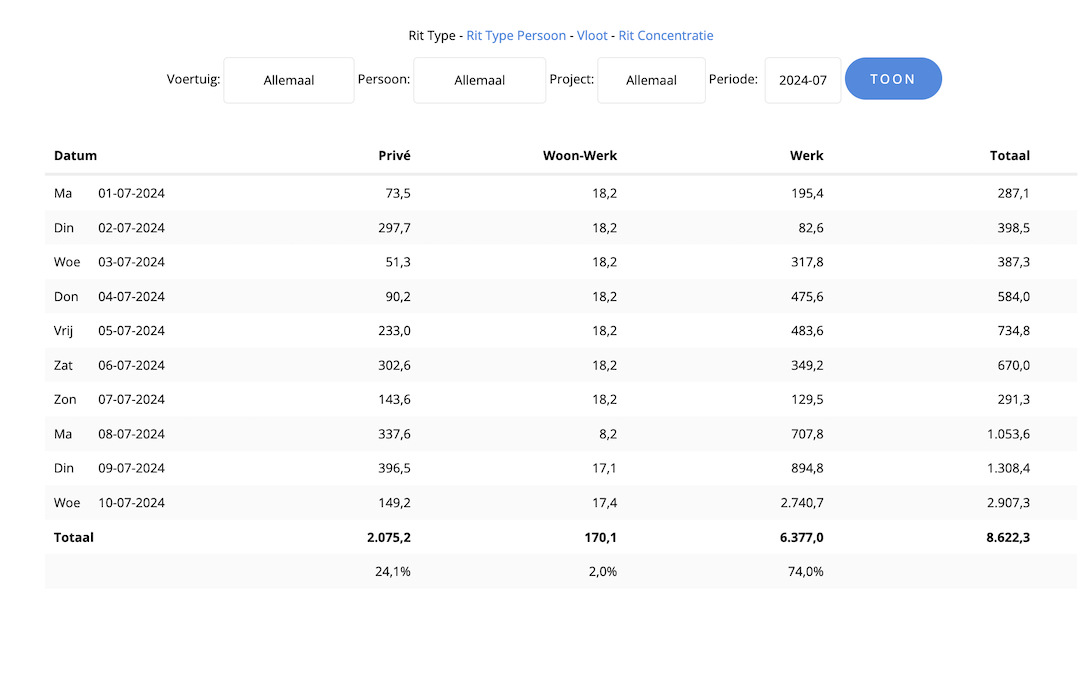

Automatic Reports

Because keeping track of the administration of daily trips requires military discipline and the avoidance of BIK goes hand in hand with it, ProDongle has automated this monkish job.

Specific functions

- Detailed registration of all trips

- Automatic classification as professional, private or commuting

- Weekly email with trip report

- All information is kept for 3 years

- Plug & Play Solution without installation